In the fast-paced world of cryptocurrencies, one must always stay ahead of the trends, especially when it comes to Bitcoin mining. The profitability of mining Bitcoin can fluctuate wildly based on various factors, so understanding how to calculate potential returns on investment (ROI) is crucial for miners and investors alike.

First and foremost, the profitability of mining Bitcoin is dependent on the current market conditions. The price of Bitcoin, the difficulty level of mining, and the cost of electricity are the trifecta that determines whether your mining venture will be lucrative or a financial drain. As the network grows and more miners join the fray, the difficulty increases, making it crucial for miners to deploy effective strategies—enter the Bitcoin mining profitability calculator.

These calculators are indispensable tools for potential and seasoned miners alike. They allow users to input variables such as hash rate, power consumption, power cost, and block rewards to receive a concrete estimate of daily, weekly, or monthly profits. By understanding the nuances of your mining operation and market dynamics, you can make more informed decisions to enhance your ROI. The calculations can be complex, but they are vital for operational excellence.

One critical aspect that influences Bitcoin mining profitability is the efficiency of your mining rig. An optimized mining rig can significantly enhance your overall yield. Miners need to focus on purchasing high-efficiency ASIC (Application-Specific Integrated Circuit) miners, which are purpose-built for Bitcoin mining. This focus should also extend to making software optimizations and configuring hardware settings to align with the current network conditions. In the highly competitive landscape of Bitcoin mining, even the smallest efficiency enhancements can lead to noticeable revenue increases over time.

Additionally, electricity costs are another game-changer. Mining is an energy-intensive process that requires substantial electricity to run numerous machines continuously. Consequently, finding a reliable and cost-effective energy source is essential. Many miners are now opting for renewable sources such as solar or wind energy, not only to reduce their operational costs but also to contribute positively to environmental sustainability.

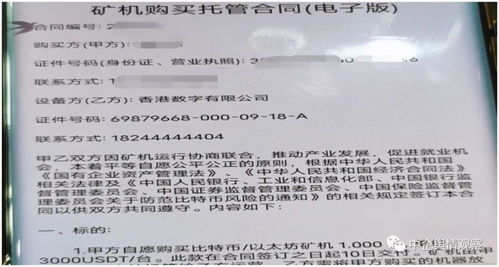

Investing in hosting services for your mining machines can be a strategic decision that influences profitability. These services offer professional management of your mining rigs, providing optimal cooling, maintenance, and electricity costs that individual miners might struggle to manage. Hosting can free miners from the technical hassles and allow them to focus purely on the profit-generating aspects of mining. Thus, it can be a crucial part of heightening the ROI equation.

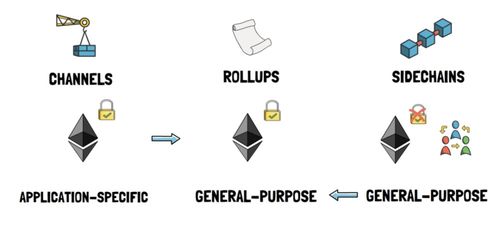

For those who are brand new to mining, it’s paramount to understand how various aspects interconnect within the wider cryptocurrency ecosystem. Bitcoin isn’t just another digital currency; it’s a robust financial system. Assessing the market for emerging altcoins like Ethereum or Dogecoin can also be lucrative. Each coin offers unique technical challenges and opportunities, which can impact your profitability in different ways. Therefore, diversifying your mining portfolio can be a strategic risk management tactic.

One must also pay attention to exchange rates. The ever-fluctuating value of Bitcoin and other cryptocurrencies means that your profitability can shift in the blink of an eye. It’s wise for miners to keep abreast of market trends and projections, as knowing when to cash in can significantly affect your overall returns.

The world of cryptocurrency mining is vibrant, filled with opportunities for those willing to learn and adapt. Calculating profitability requires a multidisciplinary approach—analyzing market trends, optimizing mining hardware, and exploring different hosting options can significantly help maximize ROI. As the digital currency landscape evolves, so must the strategies employed to maintain a competitive edge in this thrilling, albeit challenging game.

In conclusion, utilizing a Bitcoin mining profitability calculator is just one step in the journey towards maximizing your ROI. The miners who succeed are not merely those who have the best hardware or the lowest electricity costs, but those who understand the intricate dance between market forces, technological advancements, and efficient management. Crypto mining isn’t just a hobby or a side hustle; for many, it’s a full-fledged business, and being well-informed is key to reaping the rewards it offers—provided you’re willing to put in the work to stay ahead of the curve.

A vital tool! This Bitcoin mining calculator demystifies ROI, tackling electricity costs and hashrate variables. Optimize strategies, predict gains, and navigate volatile crypto waters. Essential for miners!