In recent years, the cryptocurrency landscape has blossomed into a multifaceted domain, with mining becoming a crucial pillar supporting myriad digital currencies such as Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG). As traditional mining methods face scrutiny over their environmental implications, the rise of green mining farms presents a more sustainable alternative for investors keen on entering this thrilling realm. For new players considering investments in hosting contracts, it’s paramount to navigate the complex legal frameworks that govern these arrangements.

Initially, understanding the fundamentals of mining farms is essential. These facilities house an array of specialized computers, known as mining rigs, that perform the vital work of validating transactions on the blockchain. However, the energy consumption of traditional mining practices has raised red flags. This has prompted an overwhelming shift towards greener alternatives, where energy sources like solar and wind are leveraged, minimizing the carbon footprint while maximizing profitability. In this context, hosting contracts become a lucrative opportunity for both investors and mining operators.

The legal framework surrounding mining farm hosting contracts is inherently complex, often varying significantly based on jurisdiction. Investors must consider numerous factors—including local regulations regarding cryptocurrency mining, environmental standards, and contractual obligations. Due diligence is crucial in assessing whether the hosting provider adheres to relevant laws and ethical practices. Contracts should explicitly outline the terms of service, including energy sourcing and liability, to safeguard the interests of all involved.

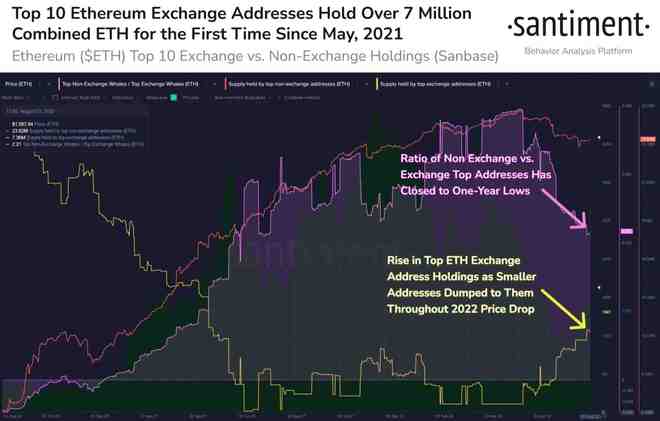

Moreover, investors should be aware that the value proposition of mining contracts hinges not only on the performance of the mining rigs but also on the volatility of the cryptocurrency market. For instance, fluctuations in Bitcoin’s market value can significantly impact the profitability of mining operations. Hence, a robust legal framework should account for volatility and economic risks, ensuring that investors are shielded from potential losses during downturns.

Another critical aspect of navigating these contracts pertains to the clarity of terms around profit-sharing, maintenance responsibilities, and equipment upgrades. Investors must decipher intricate terms that map out how mining revenues are distributed among investors and operators. Misunderstanding these terms can lead to frustrations and legal disputes—something any astute investor would wish to avoid.

As the cryptocurrency market continues to evolve, the regulatory landscape is simultaneously undergoing transformation. Countries worldwide are developing specific legislation aimed at mining activities, often coupled with initiatives encouraging sustainable practices. Investors involved in green mining technologies may find themselves well-positioned, as many governments aim to support clean energy projects. Staying updated on governmental policies and changes in regulations can unlock significant opportunities for responsible investment.

Furthermore, the need for a supportive community and shared knowledge cannot be overstated. Engaging with industry forums, attending conferences, and networking can provide valuable insights into best practices for successful mining operations. Communities of investors and operators are often on the cutting edge of technological advancements in mining hardware and software, which can impact profitability and operational efficiencies. Sharing experiences and resources within these communities can aid new investors in making informed decisions.

Finally, as the demand for cryptocurrencies continues to surge, the importance of transparency in hosting contracts cannot be overstated. Investors must be proactive in seeking information about the operators’ practices, such as their sourcing of energy, the efficiency of equipment used, and overall operational transparency. Such scrutiny not only ensures adherence to legal obligations but also fosters trust between investors and hosting providers.

In conclusion, new investors stepping into the exciting yet tumultuous world of cryptocurrency mining must prioritize understanding the legal frameworks surrounding green mining farm hosting contracts. By remaining vigilant, conducting thorough research, and actively participating in the cryptocurrency community, investors can navigate this landscape confidently. Embracing sustainability in mining may not only lead to profitability but also contribute to a greener future for the planet—benefitting both new investors and the industry at large.

This insightful guide demystifies green mining contracts’ legal intricacies for newcomers, blending environmental ethics with investment savvy. Its unpredictable focus on emerging risks adds fresh, empowering twists for eco-minded investors.